Ethereum Price Prediction: Analyzing the Path to $4,800 and Beyond

#ETH

- Technical Breakout Potential: ETH's current position below the 20-day MA but with strong MACD momentum suggests imminent upward movement toward $4,800 resistance levels

- Institutional Accumulation: Significant institutional investments totaling $3.6B in Ethereum indicate growing confidence among major financial players

- Regulatory Clarity: Recent legal precedents involving crypto mixers provide clearer regulatory framework, reducing uncertainty for institutional adoption

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

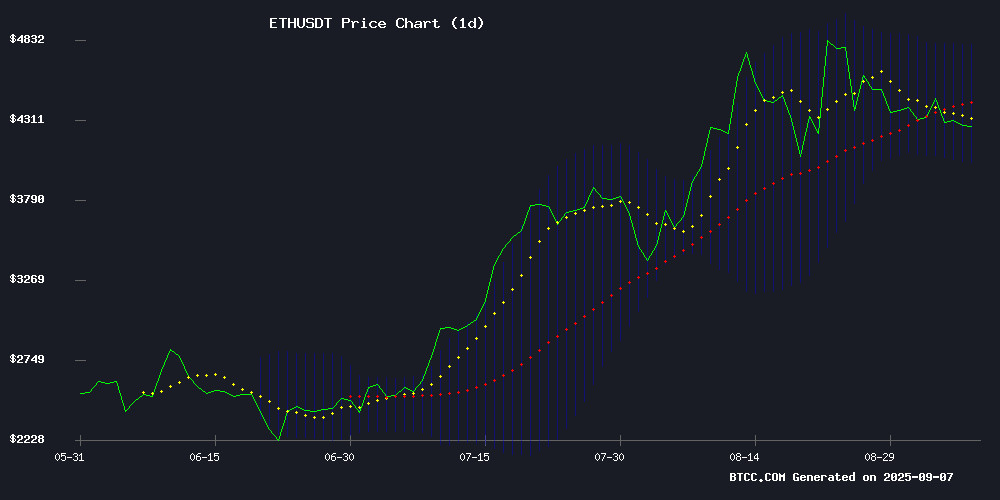

ETH is currently trading at $4,304.99, sitting below its 20-day moving average of $4,421.14, indicating some near-term resistance. However, the MACD reading of 162.18 versus its signal line at 13.22 shows strong bullish momentum, with a significant histogram value of 148.96. The Bollinger Bands position the upper band at $4,803.67 and the lower band at $4,038.61, suggesting potential upside toward the $4,800 level if buying pressure continues.

According to BTCC financial analyst Mia, 'The technical setup suggests consolidation around current levels with a bias toward testing the upper Bollinger Band. The MACD divergence is particularly encouraging for bulls looking for a MOVE toward $4,500-$4,800 in the coming weeks.'

Market Sentiment: Institutional Accumulation and Regulatory Clarity Boost ETH Outlook

Recent news flow surrounding ethereum has been overwhelmingly positive, with multiple catalysts supporting a bullish medium-term outlook. SharpLink Gaming's $3.6 billion Ethereum accumulation signals growing institutional confidence, while legal clarity around crypto mixers following the Tornado Cash and Samourai Wallet cases removes regulatory overhangs.

BTCC financial analyst Mia notes, 'The combination of institutional demand, regulatory progress, and technical consolidation creates a favorable environment for ETH. While weekly ETF outflows present short-term headwinds, the underlying fundamentals remain strong with analysts targeting $4,750 by mid-September and longer-term projections reaching as high as $62,000.'

Factors Influencing ETH's Price

Ethereum Outflows Signal Bullish Setup for ETH Price

Ethereum's supply dynamics are tightening as institutional investors accelerate withdrawals from major exchanges. Binance's Exchange Supply Ratio for ETH fell sharply from 0.041 to 0.037 between August 16 and September 3—the steepest two-week decline observed this year.

The migration of ETH from exchange wallets to cold storage reflects growing conviction among long-term holders. Historical patterns suggest such supply squeezes typically precede upward price movements, as reduced liquidity amplifies buying pressure against constrained sell-side availability.

Despite trading in a $4,200-$4,500 range since its August 23 peak of $4,956, Ethereum's on-chain metrics paint a decidedly bullish picture. The market appears to be consolidating before its next leg higher, with exchange outflows serving as the clearest indicator of accumulating demand.

Ethereum Eyes $4,500-$4,800 Target Amid Consolidation

Ethereum's price action at $4,291 sets the stage for a potential breakout, with analysts converging on a $4,400-$4,800 target range within the next 30 days. Immediate resistance looms at $4,400, while critical support holds firm at $4,060.

Technical indicators paint a mixed picture—ETH trades below key moving averages but maintains robust yearly gains. The Bollinger Bands and bullish trend classification support CoinCodex's aggressive $4,796 medium-term target, an 11.8% upside from current levels.

Market consensus emerges across platforms: Cryptonews targets $4,371, Changelly projects $4,508, and Bitget aligns with resistance clusters at $4,408. This alignment suggests institutional confidence in ETH's upward trajectory despite near-term consolidation.

Legal Clarity Emerges on Crypto Mixers as Tornado Cash and Samourai Wallet Cases Set Precedents

Recent legal developments involving Tornado Cash and Samourai Wallet have brought unprecedented clarity to the regulatory stance on cryptocurrency mixers. The cases dismantle a long-held Web3 argument that non-custodial services operate beyond legal jurisdiction as "mere software."

Authorities now treat privacy-focused protocols as actionable financial services rather than neutral code. This shift mirrors global regulatory trends targeting anonymity tools, with prosecutors successfully arguing that mixer architectures demonstrate intent to facilitate money laundering.

SharpLink Gaming Amasses $3.6B in Ethereum as Institutional Confidence Grows

SharpLink Gaming, a Nasdaq-listed company, has solidified its position as one of the largest institutional holders of Ethereum, accumulating 837,230 ETH worth approximately $3.61 billion. The latest purchase of 39,008 ETH at an average price of $4,531 underscores its long-term treasury strategy, aligning with the future of decentralized finance and tokenized economies.

Ethereum's resilience above $4,200 contrasts with retail caution as the asset struggles to reclaim $4,500. While smaller investors remain wary of volatility, SharpLink's aggressive accumulation signals institutional conviction in ETH's foundational role in digital asset markets.

Ethereum ETFs See Second-Highest Weekly Outflows Amid Bearish Pressure

Ethereum ETFs recorded their second-largest weekly outflows, with $787 million exiting the funds in early September. Institutional confidence appears to wane as negative flows persist since August 29, creating headwinds for ETH's price recovery.

The cryptocurrency tested key support at $4,300 despite mounting sell pressure, with its RSI hovering at neutral territory—reflecting a stalemate between bulls and bears. Market observers warn continued outflows could trigger deeper liquidity withdrawals in coming weeks.

ETF flows have emerged as a critical sentiment indicator since launch. The sustained capital flight suggests institutions remain skeptical about near-term upside potential, potentially prolonging ETH's consolidation phase.

Ethereum Eyes $5,000 as Institutional Demand Grows

Ethereum's price resilience near $4,290 underscores mounting institutional interest, with whale accumulation and ETF inflows bolstering its position. A triple bottom pattern signals potential bullish momentum, targeting $5,000 if resistance at $4,500 breaks.

Analysts highlight $4,250 as critical support, while trader Merlijn The Trader notes the setup is 'loaded' for an upward surge. The convergence of technical indicators and growing demand paints a compelling case for ETH's next major rally.

Ehereum Nears Critical Resistance as Analysts Target $4,750 by Mid-September

Ethereum stands at a pivotal technical crossroads, with bulls mounting another assault on the $4,500 resistance level. A successful breakout could propel ETH toward $4,750-$4,850 within weeks, potentially setting the stage for a run at $5,000. The asset currently trades at $4,317, buoyed by its position above key moving averages despite neutral momentum indicators.

Market analysts diverge on timing but maintain bullish consensus. CoinDCX sees near-term potential to $4,500, while Changelly's AI model projects an ambitious $4,687 target. LiteFinance strikes a cautious note, identifying $4,095 as immediate resistance while acknowledging Ethereum's structural strength. The $4,060 support level remains critical should bearish pressure emerge.

Wall Street's Needs Will Advance Ethereum's Privacy, Says Etherealize

Wall Street's embrace of cryptocurrency will drive privacy innovations on Ethereum, according to Danny Ryan, co-founder of Etherealize. The firm is developing infrastructure for trading and settling tokenized equities, leveraging zero-knowledge proofs to meet institutional demands.

"The market cannot function fully in the clear," Ryan asserts. Public blockchains expose transaction trails, a non-starter for treasury operations and trading strategies. Etherealize's $40 million funding round will fuel Ethereum-based solutions that balance transparency with Wall Street's privacy requirements.

ARK Invest Boosts Crypto Equity Holdings with $23.5M BitMine and Bullish Purchases

Cathie Wood's ARK Invest intensified its crypto market exposure Friday, acquiring $23.5 million worth of shares in BitMine Immersion Technologies and Bullish across three flagship ETFs. The investment firm's Innovation ETF (ARKK) took the lion's share, purchasing 257,108 BitMine shares and 81,811 Bullish shares, while ARKW and ARKF split the remaining 129,892 BitMine and 62,189 Bullish shares.

BitMine, currently holding 1.87 million ETH worth $8 billion as ether's largest treasury firm, saw its shares dip 0.3% during Friday's session followed by a 1.17% after-hours decline. Bullish, which went public in August through a $1.1 billion IPO after abandoning its SPAC merger plan, gained 6% during the trading day before retreating 1.5% post-market.

The acquisitions come alongside ARK's strategic reductions in DraftKings, Roku, Roblox and Teradyne positions. Notably, ARK had previously demonstrated strong conviction in Bullish, purchasing $172 million worth of shares during the exchange's debut trading day.

Ethereum Holds Steady as Binance Supply Shrinks, Fueling Rally Speculation

Ethereum's price resilience at $4,330 contrasts with a sharp decline in Binance-held ETH, dropping from a 0.041 to 0.037 exchange supply ratio since mid-August. The divergence suggests accumulation rather than distribution—a historically bullish signal when supply tightens without price deterioration.

Consolidation between $4,240 support and $4,480 resistance mirrors the 2021 bull market's structural basing pattern. Market makers appear to be defending the $4,300 level as on-chain liquidity evaporates from exchange wallets.

Binance's dominance in ETH holdings amplifies the significance of its supply drop. The absence of sell-side pressure during this outflow implies institutional custody migration, echoing Bitcoin's 2020 pre-bull market exchange balance collapse.

Tom Lee's Bold Ethereum Prediction: $62K Target Amid Market Divergence

Ethereum holds steady at $4,371.29, with a $527.63 billion market cap and $32.79 billion in daily trading volume. Fundstrat's Tom Lee projects a long-term target of $62,000 per ETH, citing Wyckoff's "big base, big breakout" theory and Ethereum's expanding role in global finance. The forecast implies a 15x return from current levels.

Short-term traders are pivoting to meme tokens like Maxi Doge, which raised $1.84 million in presale ahead of a scheduled price hike. The divergence highlights crypto's enduring tension between fundamental believers and speculative opportunists.

Lee's analysis draws parallels to Ethereum's 2020-2021 rally from $90 to $4,866, suggesting prolonged accumulation phases precede major breakouts. "Ethereum is building the financial infrastructure of Web3," he noted, positioning ETH as a blue-chip asset with asymmetric upside.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and fundamental developments, here are our projections for Ethereum's price trajectory:

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $4,800 - $5,200 | ETF adoption, institutional accumulation, technical breakout |

| 2030 | $12,000 - $15,000 | Mass adoption, scalability solutions, DeFi growth |

| 2035 | $25,000 - $35,000 | Global digital economy integration, Ethereum 3.0 upgrades |

| 2040 | $50,000 - $62,000 | Store of value status, complete financial system integration |

BTCC financial analyst Mia emphasizes that 'These projections assume continued institutional adoption, successful protocol upgrades, and favorable regulatory developments. Short-term targets around $4,800 appear achievable given current momentum, while longer-term forecasts depend on Ethereum maintaining its leadership in smart contracts and decentralized applications.'